Let's talk about money. You either have it, or you don't. Just so you know, the universe does not care if you're on either end of the spectrum. Unexpected situations call for unexpected measures, most times an unexpected dent on the financial end. It's called an emergency folks and I feel like I have been in a bunch of these sticky situations.

Now that I think about it, those weren't even problems. They were more like speed bumps. I was broke, could barely afford lunch so if class happened to end at midday you wouldn't find me or my growling tummy hanging around campus, I'd make a beeline for home, read, free food. Back when I was in a college with a dress code, times were rough. On the flip side, with my limited options, getting dressed in the morning was pretty easy but when my clothes started to wear out, I don't even remember what I did. The solutions were easy then, I didn't have the money to do something about the situation so I would move on as if my life wasn't in shambles.

The irony is I am a step up, I'm not even going to downplay it, I am several steps up from where I was financially just a few years ago, can I get an Amen? Here is the ironic part though, even when I'm in a pickle now, I still get a little bit flustered on how I am supposed to deal. Now that I've said that out loud it seems to me that I did not have a plan and I still don't have one and you know what they say, failure to plan is planning to fail.

This post was inspired by Joanna Kinuthia who is one of my favourite Kenyan Youtubers and a rising star in her own right. In her most recent vlog, the girl seems to have drawn up quite a mean plan when it comes to this thing called money. Expenses first, loans second, savings third only then can everything else make guest appearances on your budget that month.

Here is a little expose on yours truly; all of last year all my money would go into my current account. I was saving in that account, spending from that account, goal setting based on that account and planning around that account. If I ever so much as spent even a shilling more I would run into a panic thinking that my financial life would crumble right before my very eyes.

My first six months of employment I enjoyed only a fraction of my pay. Then, it clicked. My expenses can't even fill half a page. I am not paying rent, utility bills, student loans, other loans, car payments, insurance payments, tuition or maintenance fees. Just so you follow, that is what I am not paying. I may be the very epitome of living life like it's golden. All I do is sit pretty and pay security and the trash service every other month, contribute to my table banking and put money aside for my bus fair every month and every few months shop for stationery and toiletries. Everything else is, pretty much, no man's land, where anything and everything goes.

Last year is when I came to this eye-opening discovery and went a little crazy spending wise. I mean my expenses barely scrape the surface so why not? Before I dug myself into a financial hole I pumped the brakes and figured that maybe, just maybe, putting all my eggs in one basket wasn't the brightest of ideas.

Earlier this year was when I made the decision to get my finances in order. I resolved to set up a savings account and invest in the money markets. It was only last month that my grand scheme of things were put to work and I will admit that it is still a work in progress; trying to figure out how to make an account-to-account transfer and what not.

The lessons I learnt though:

Your first paycheck is not a license to go on a spending spree. Neither is your second or third. Live life like you were before. Spoil yourself here and there but everything in moderation. When you have quite the amount stacked up, though, start making the plans. Six months in is a good time frame to work with fastening your financial belt.

Have a separate savings account from the get go. Why? Most banks don't allow you to touch that for at least six months and if you do, be prepared to dig deeper into your pocket to pay off the penalty charge.

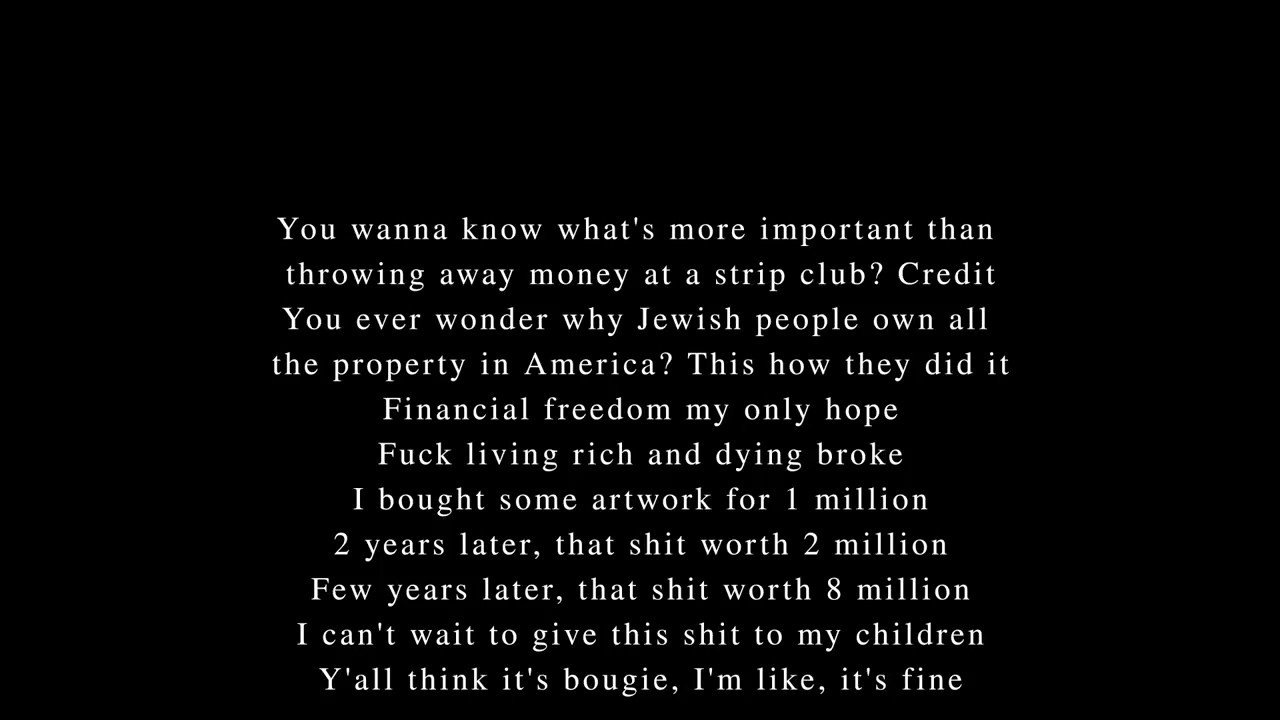

Don't just let your money sit there. Now that's just pointless. Banking, it already earns you a certain interest rate, so do that. Be in a merry-go-round or two, contribute then wait your turn. Of course, be in one with people of reputable character. You don't want to be in one with the guy who defers on payment every single month or the guy who just ups and leaves, get a couple of A1 day-ones and its only up from there. Invest in stock and bonds, with these things though it's more about having your change in all these venues doing something. The dividends are negligible sometimes none but interest in bonds that's something, 0.5% every three months. I can assure you that that is pretty solid. When you hit a rough patch sell your shares and if the stock market is doing well, you'll probably be going off having made a profit. This move was majorly inspired by Hove himself and these lyrics from The Story of O.J off the 4.44 album, sorry, platinum album:

Disclaimer: I may be singing a different tune if my stock does badly or interest on bonds is not paid out so until then use your discretion on this one.

My next few posts I hope to write on having an emergency fund, setting up more than one bank account and my 2018 financial plans. These could be one post or a couple, depends on how the words will flow. But keeping with the purist school of thought, they are probably going to be a couple.

Until then though, do something worthwhile with your money today, no excuses.

Have a good one!

No comments :

Post a Comment